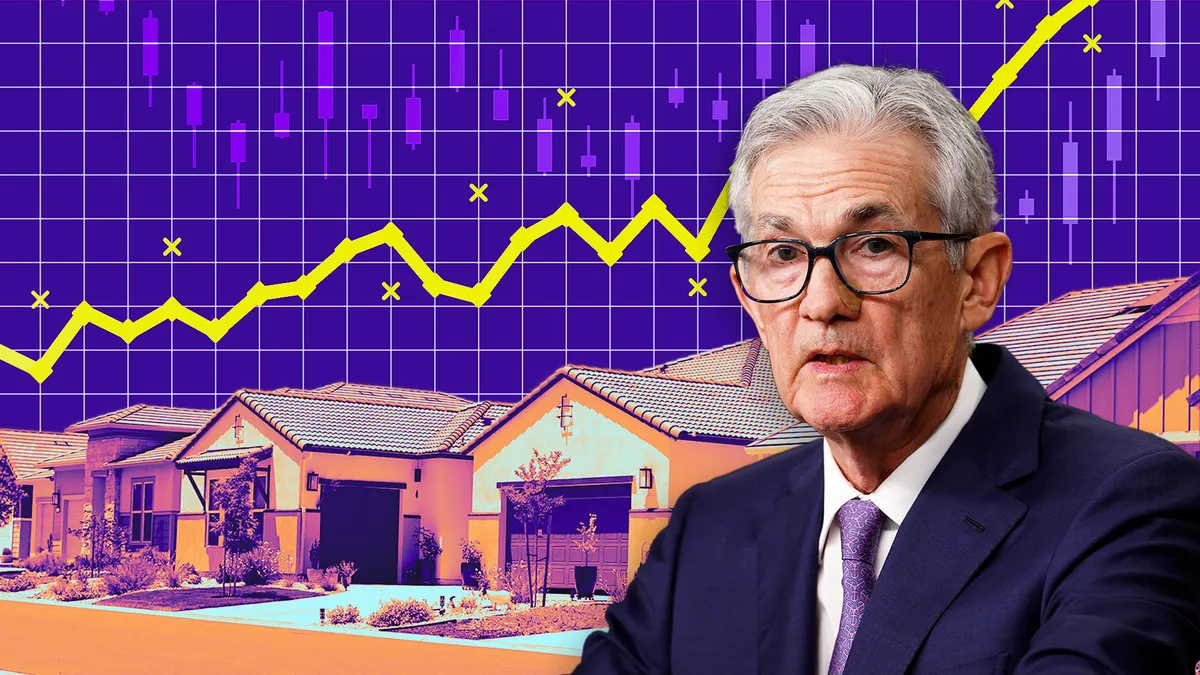

Why Mortgage Rates Can Stay High Even When the Fed Cuts Rates

- LongVo

- February 10, 2026

Why Mortgage Rates Can Stay High Even When the Fed Cuts Rates

It’s a common misconception that when the Federal Reserve lowers interest rates, mortgage rates will immediately follow suit. However, the relationship between Fed rate cuts and mortgage rates is more complex than many people realize.

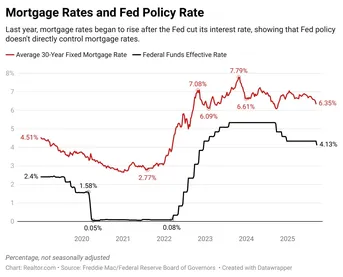

Mortgage rates are primarily influenced by the bond market, particularly the yield on the 10-year Treasury note, rather than directly by the Fed’s short-term rates. When the Fed lowers its rates, it’s typically targeting short-term borrowing costs for businesses and consumers, but mortgage rates are more closely linked to the long-term outlook for the economy, which is reflected in bond yields.

If bond yields remain elevated due to inflation concerns, strong economic data, or market uncertainty, mortgage rates can remain high even when the Fed cuts its rates. For example, if investors are worried about inflation or a robust economic recovery, they may demand higher yields on Treasury bonds, which in turn raises mortgage rates for homebuyers.

This means that even if the Fed cuts rates, homebuyers may not see an immediate reduction in mortgage costs. Mortgage rates can stay elevated until bond yields begin to fall, which could take time depending on broader economic conditions.

For now, potential homebuyers may face higher borrowing costs, even as the Fed takes steps to reduce short-term interest rates. With inflationary pressures and uncertainty lingering, mortgage rates could remain high until the broader economic outlook stabilizes and bond yields come down.

Stay tuned for more insights on the housing market and mortgage trends.